Exemplary Tips About How To Build Good Credit From Bad

Get a secured card 2.

How to build good credit from bad credit. When you add positive information to your credit reports and build up good credit scores, creditors are typically willing to offer you more attractive interest rates and borrowing. Your payment history makes up 35% of your credit score. Another good way to build credit is by applying for a new credit card.

Report your rent to credit bureaus when you have bad credit, it’s important to use every tool you can to start rebuilding your credit score. Start with your credit reports before you can create an effective plan to rebuild your credit, you need to understand where you stand now. Order a copy of your credit.

Get credit for the bills. Also known as “piggybacking,” becoming an authorized user is when someone adds you to their credit card account. Get added as an authorized user becoming an authorized user is one of the most popular ways to build your credit score because you benefit from someone else’s good, established credit history.

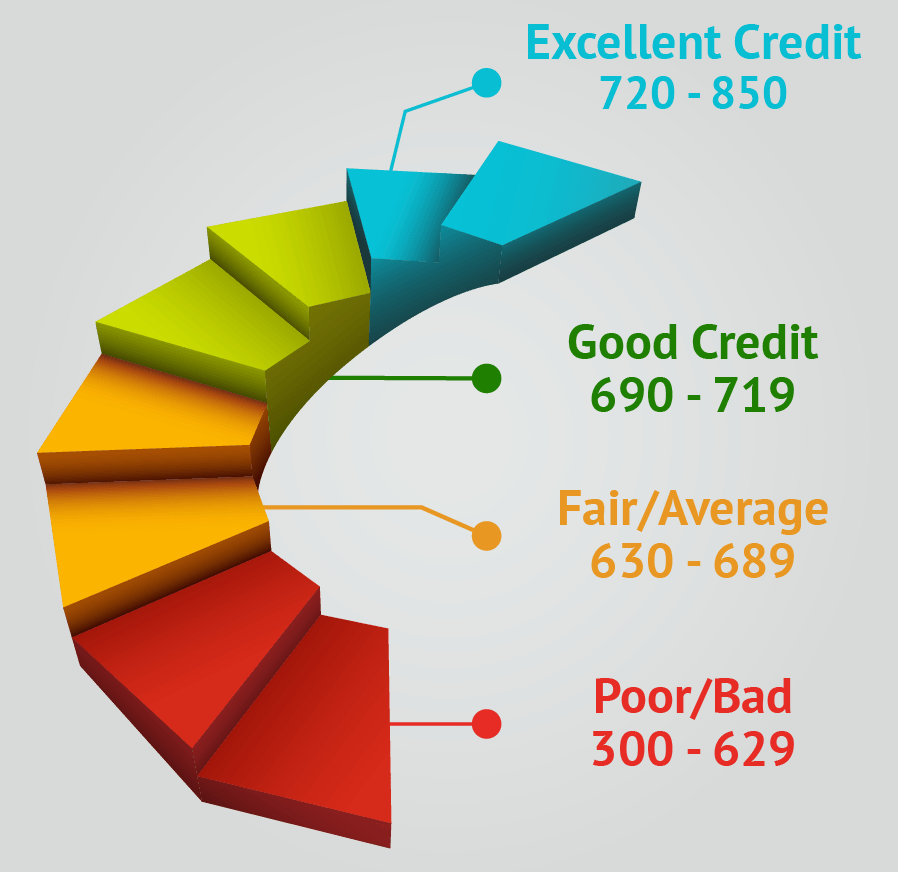

You need to build a decent recent history to show that you can be responsible with credit and use it well. Here are the ranges experian defines as poor, fair, good, very good and exceptional. To build credit, you need to obtain credit—and opening a credit card account can be a way to accomplish that goal.

You “secure” the card with a. So if you want to fix your credit, you should focus on ironing out your. How to build credit 1.

Let’s say you have two. Review your current credit score before you can go about fixing a problem, you need to identify what the problem actually is. The best way to build good credit is to create the habit of charging only what you can afford.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards. A secured credit card can also help pad a thin file. Easier to qualify for compared to.

Slowly build your credit card portfolio. Always pay your bills on time. Provides tools to help build credit.

This habit lets future lenders and creditors know you're a. When you add a new credit card to your portfolio, you can increase your available.