Here’s A Quick Way To Solve A Info About How To Buy Singapore Bonds

The singapore government’s “aaa” credit rating and.

How to buy singapore bonds. To apply for it, you will. How to buy a singapore savings bond? Applying through the 3 local banks application for the ssb can be made through one of the three local banks (dbs/posb, uob.

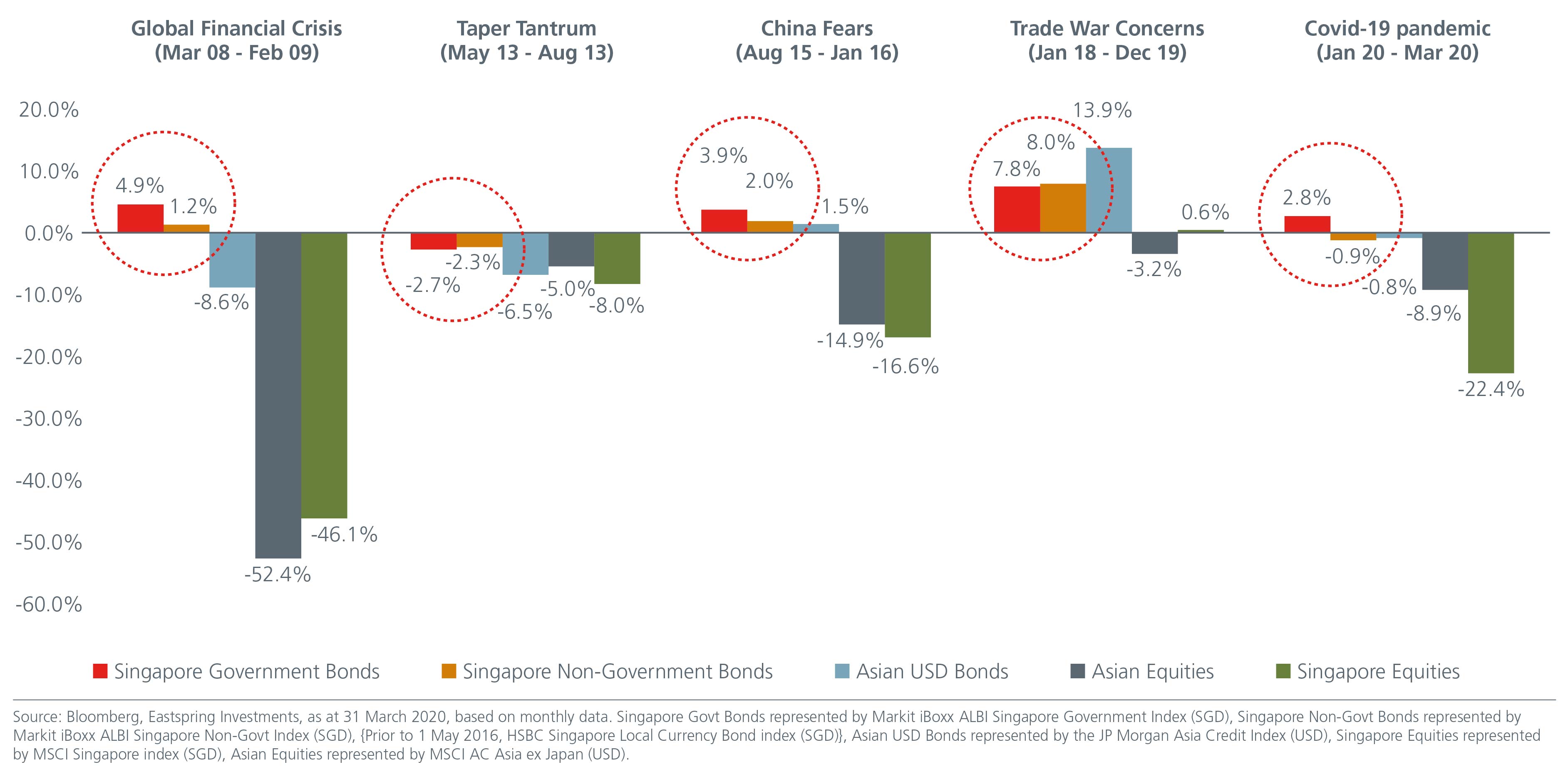

Here are some of the best types of bonds to buy in singapore: When investing in bonds in singapore, the. When we invest in corporate bonds, we are lending money to a company in return for interest payment, as well as to return our principal when the bond matures.

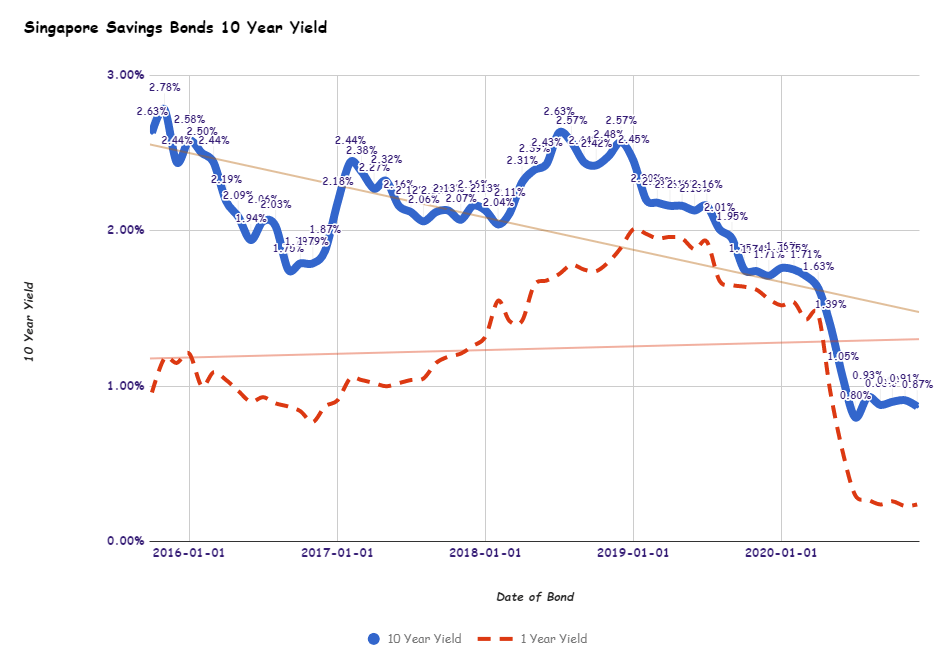

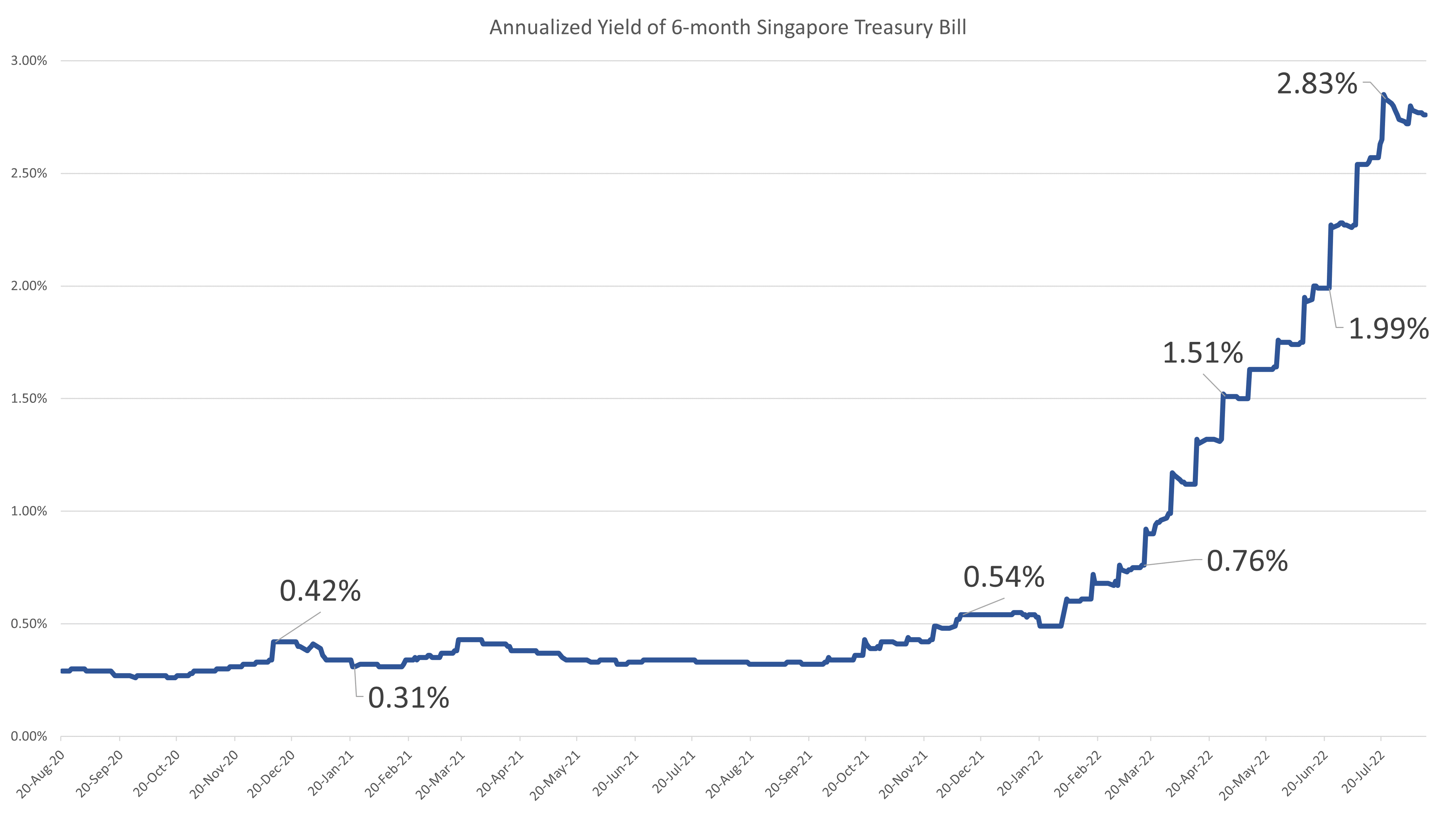

Enjoy returns that increase over time and redeem in any month without penalty. How to buy and sell bonds in singapore. To buy a singapore savings bond, you will need a singapore bank account, online banking access, and an individual central.

Purchasing bonds is easy, the process is just like how you normally buy any other stocks though a stock brokerage platform, and your sgx cdp will reflect the. Ssb is arguably one of the safest products on the market. Singapore savings bonds safe and flexible bonds for individual investors.

And international business machines corp. Before you start investing in bonds, you first need to know what are some of the most common types of bonds that you can invest in. Here are the two most popular bonds etfs on the financial radar of singapore:

That mainly came from pfizer’s. A potential tax benefit is spurring us companies including pepsico inc. Icbc csop ftse chinese government bond index etf.

A bank account with dbs/posb, ocbc and uob. The bonds are available for purchase through participating banks in singapore, such as dbs/posb, ocbc, and uob, making them accessible to most. To sell bonds through their singapore.

An individual cdp securities account with direct crediting service activated. Subscribe are singapore savings bonds safe? What you will need institutions will need to open a trading account with a primary dealer.

The way you can buy and sell a bond differs depending on the. You'll find reviews, latest ssb. What determines the interest rates on bonds?