Beautiful Work Tips About How To Reduce Money Supply

You may be able to get the discount on your gas bill instead if your supplier provides you with both gas.

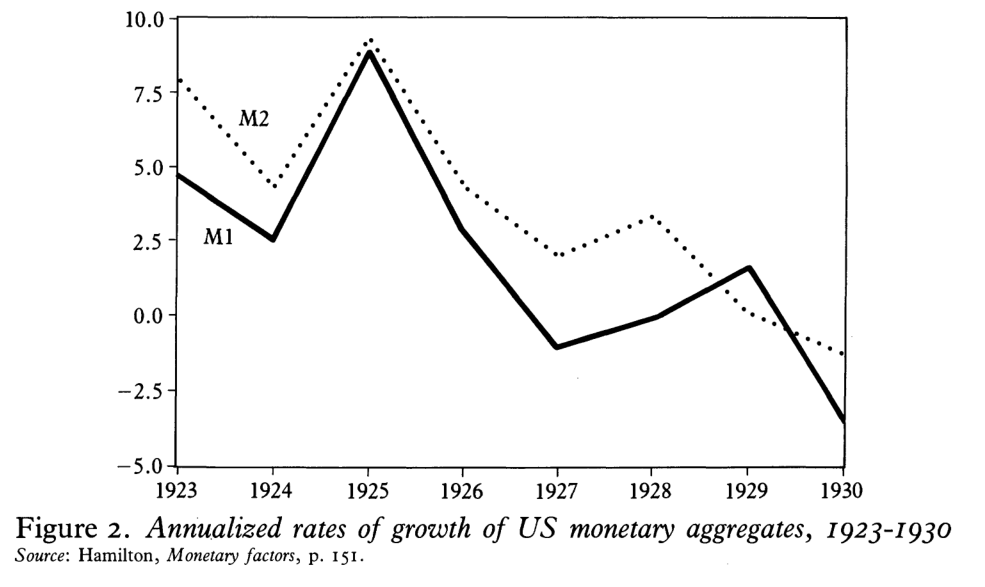

How to reduce money supply. Treasury—and various kinds of deposits held by the public. Updated june 28, 2021 reviewed by michael j boyle fact checked by daniel rathburn you may or may not have heard of the term money supply. 28 november 2021 by tejvan pettinger the money supply measures the total amount of money in the economy at a particular time.

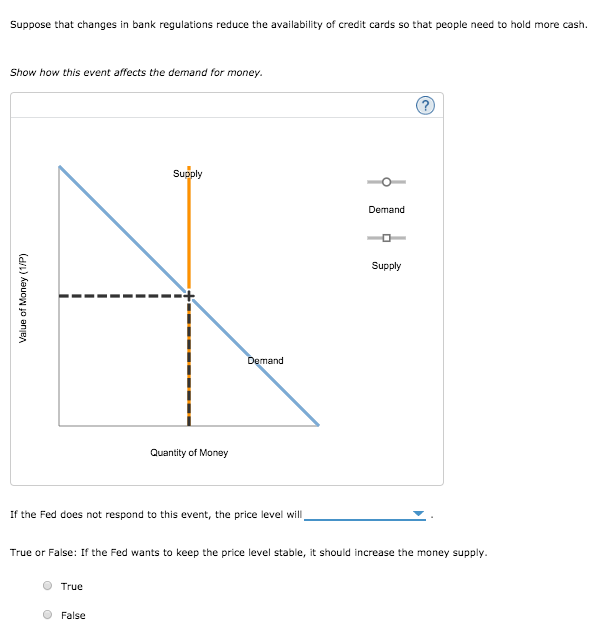

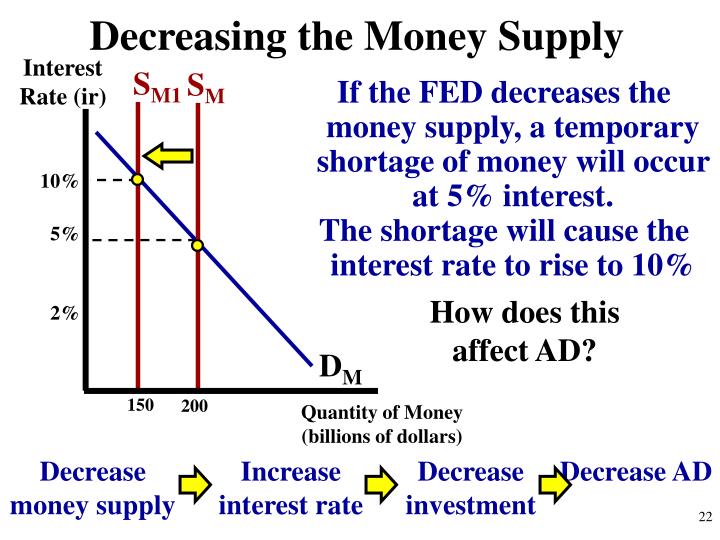

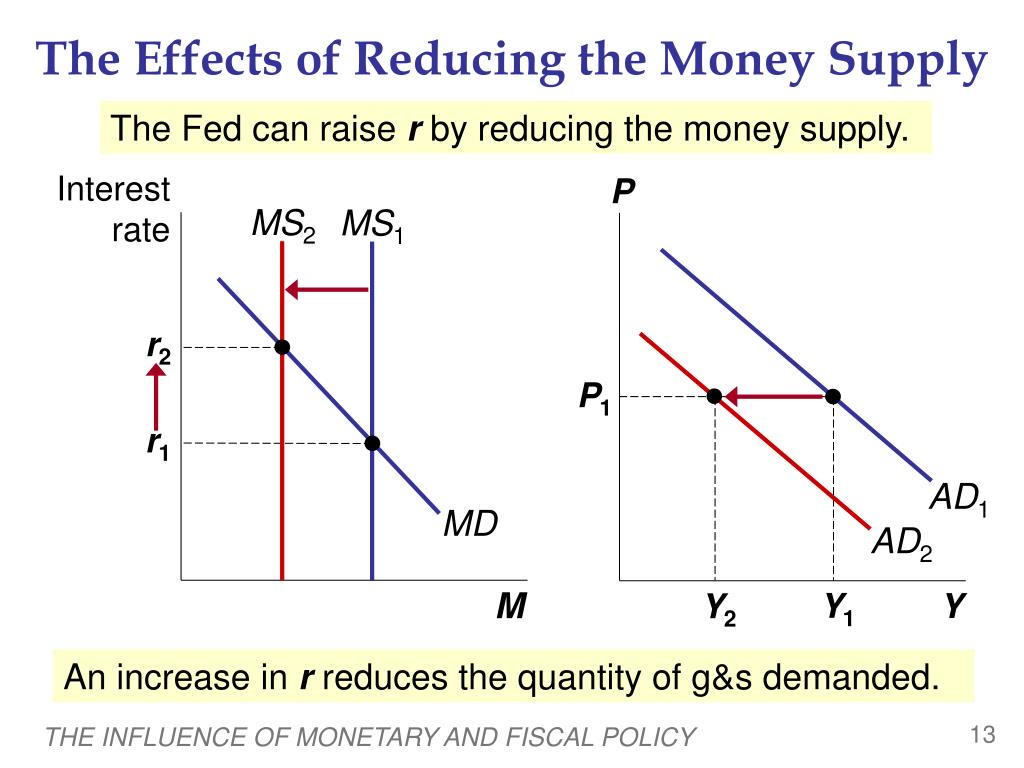

Altering the discount rate it. The money supply and the. The central bank's control of the monetary base, mb, gives it control of the money supply, m, as long as cash holdings and rr are constant.

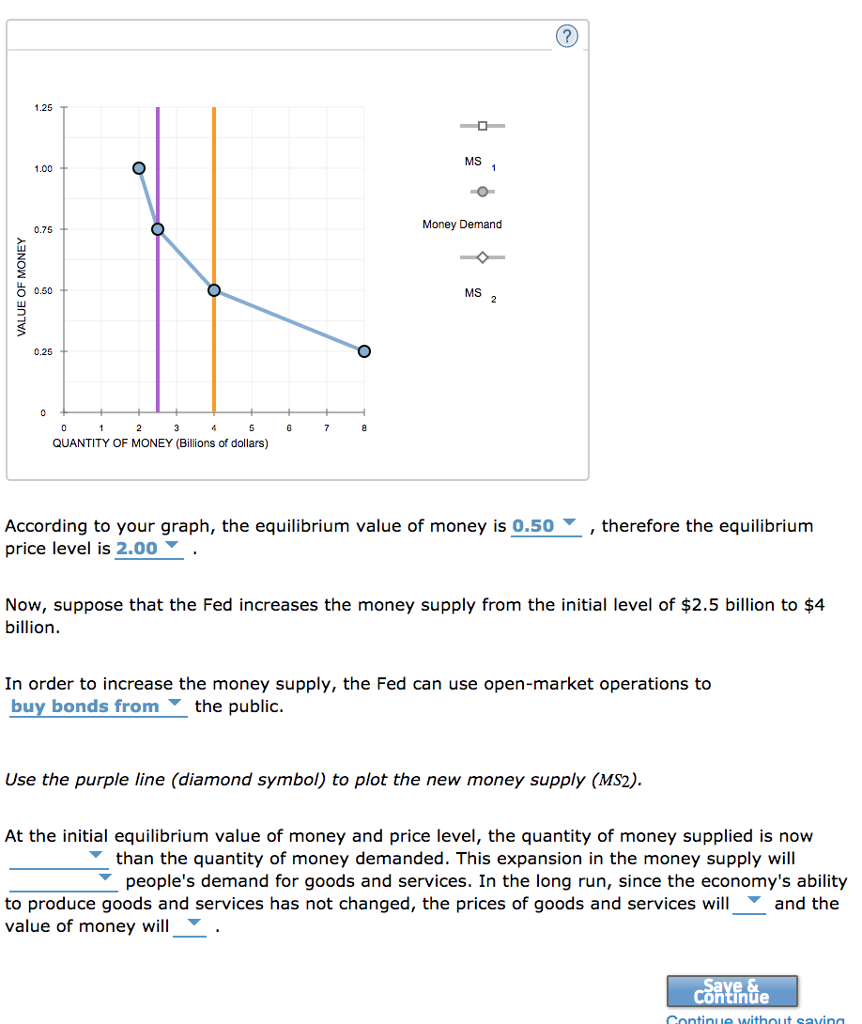

The reduction in interest rates required to restore equilibrium to the market for money after an increase in the money supply is achieved in the bond market. How does the federal reserve control the supply of money? The fed controls the supply of money by increasing or decreasing the monetary base.

The sum of currency held by the public and transaction deposits at depository institutions (which are financial institutions that obtain their funds mainly. 1 in this article, the following terms are used. Central banks use tools such as interest rates to adjust the supply of money to keep the economy humming.

Monetary policy has lived under many guises. It includes actual notes and coins and also. Tools used (primary tool in bold) 1) open market purchases (buy bonds), 2) decrease discount rate, 3) decrease reserve.

This refers to all of the liquid. Treasury yields ticked up monday, also keeping stocks under pressure. For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about 18.

Government created the federal reserve, the nation's central bank, in order to manage the money supply and prevent economic. Central bank has a variety of monetary policy tools at its disposal to implement monetary policy, affect the fed funds rate, and alter our nation's money supply. Dd = $100/ (1 − 0.9) = $1,000.

(b) in contractionary monetary policy, the central bank causes the supply of money and credit in the economy to decrease, which raises the interest rate, discouraging borrowing. This is because with more currency chasing the same quantity. In principle, there are three main ways in which businesses can create value from the decarbonization drive.

Figure 8.2 uses a diagram to illustrate. Banks are sometimes referred to as “depository institutions.”. Currently, the three ways it does this are:

Under the scheme, you could get £150 off your electricity bill for the winter. Everything else being equal, an increase in the money supply is likely to cause inflation. Modifying the interest rate that it pays on banks' reserve balances 2.