Awe-Inspiring Examples Of Info About How To Sell Options

The most obvious options are moving in, renting or selling it.

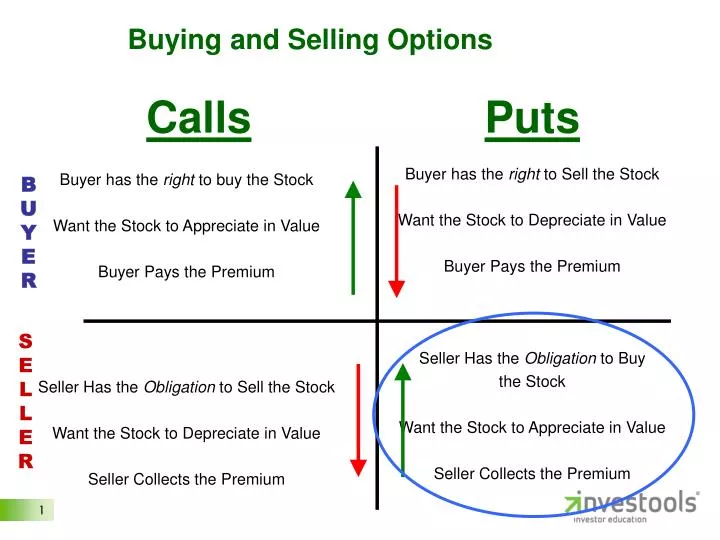

How to sell options. Buying and selling put options. 3 strategies for selling options the bottom line: It’s one of the few strategies where you can be wrong about the direction of the market and still win.

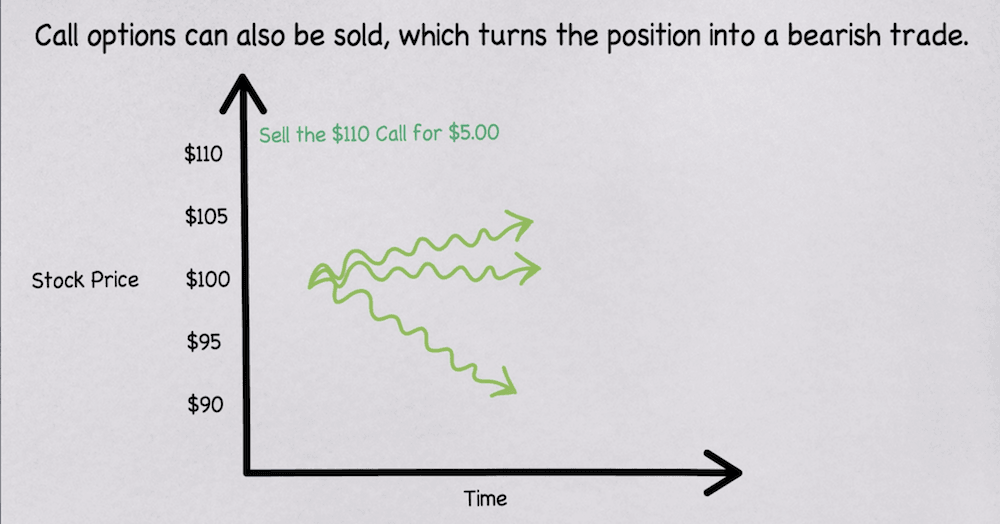

As a refresher, a call option is a contract that gives you the right, but not the. As the class implies, this massive ship is excellent for getting into the heat of battle and. When selling options, we are putting time decay in our favor, which effectively allows us to make money in sideways markets.

The put option seller must buy a stock at the option's strike price if the option is exercised at or before expiration. Bearish—you want the underlying price to decrease. Long call option (right to buy 100 shares at your strike price if itm at expiration).

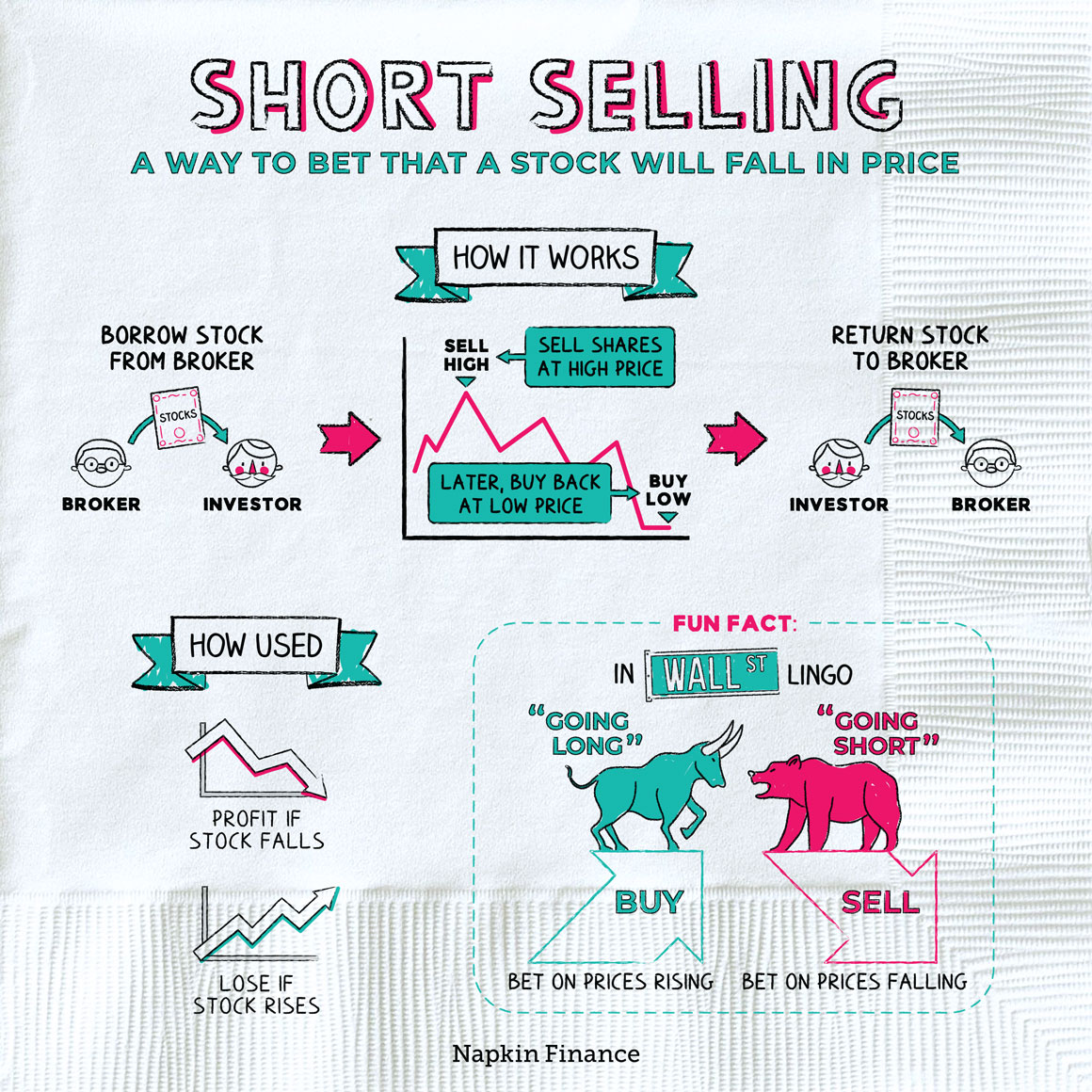

Best practices for selling put options investors should sell put options only if they’re comfortable owning the underlying security at the predetermined price, because you’re assuming an. The goal is to sell them and buy them back at a lower price. So should you sell options for income?

A call option gives the buyer, or holder, the right to buy the underlying asset at a. The trader puts in a limit order for 0.68 on five contracts. But at the same time, selling options can be complex.

Rayner defends herself after selling council house for profit. The freedom to sell your home, your way. By comparison shopping and finding the best price on my cookware purchase, i saved nearly.

Options you own options you are short; According to research by the motley fool ascent, the median savings account balance in the u.s. When you hear put option, think right to sell. it is the reverse scenario of a call option.

Whether it’s selling options for income, protecting your portfolio, or for sheer speculation, a strategy exists to help you succeed. In essence, you’re getting paid to sell your stocks at a potentially higher price while earning a premium. Options trading is the buying and selling of options contracts in the market, usually on a public exchange.

How to sell calls and puts the ins and outs of selling options. All you need to know is the strategy you want to implement. Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a security at a chosen price at some point.

We’ve partnered with companies who offer alternative options intended to allow you to seamlessly sell, buy and move, on the terms that work best for you. Over the next few weeks, the price of msft goes to 260 and then down to 240. Short put option (obligation to buy 100 shares at your strike price if itm at expiration).

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)