Exemplary Tips About How To Start A Letter The Irs

Table of browse.

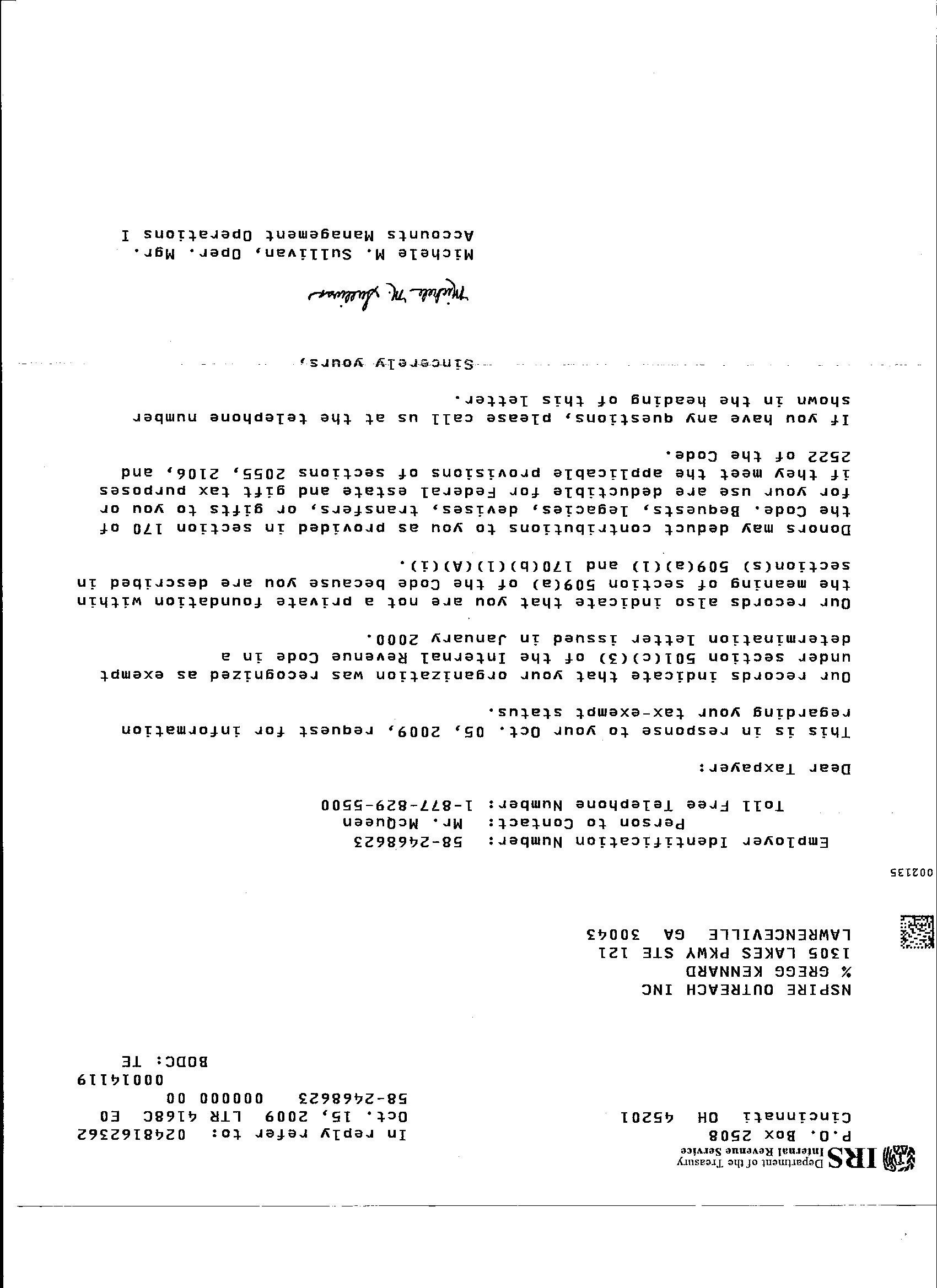

How to start a letter to the irs. Updated on december 25, 2023. Knowing this information will enable you to address the. The irs mails letters or notices to taxpayers for a variety of reasons including if:

Or speak with a representative by phone or in person. Taxpayer’s name, address, and contact information. The irs sends notices and letters for the.

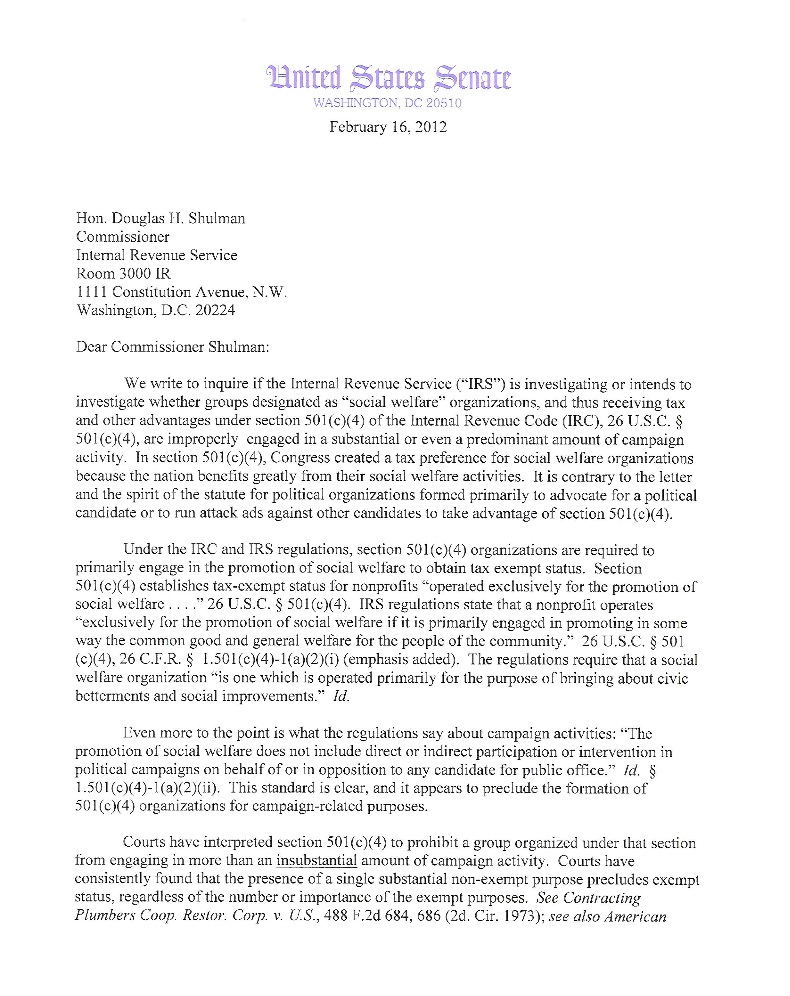

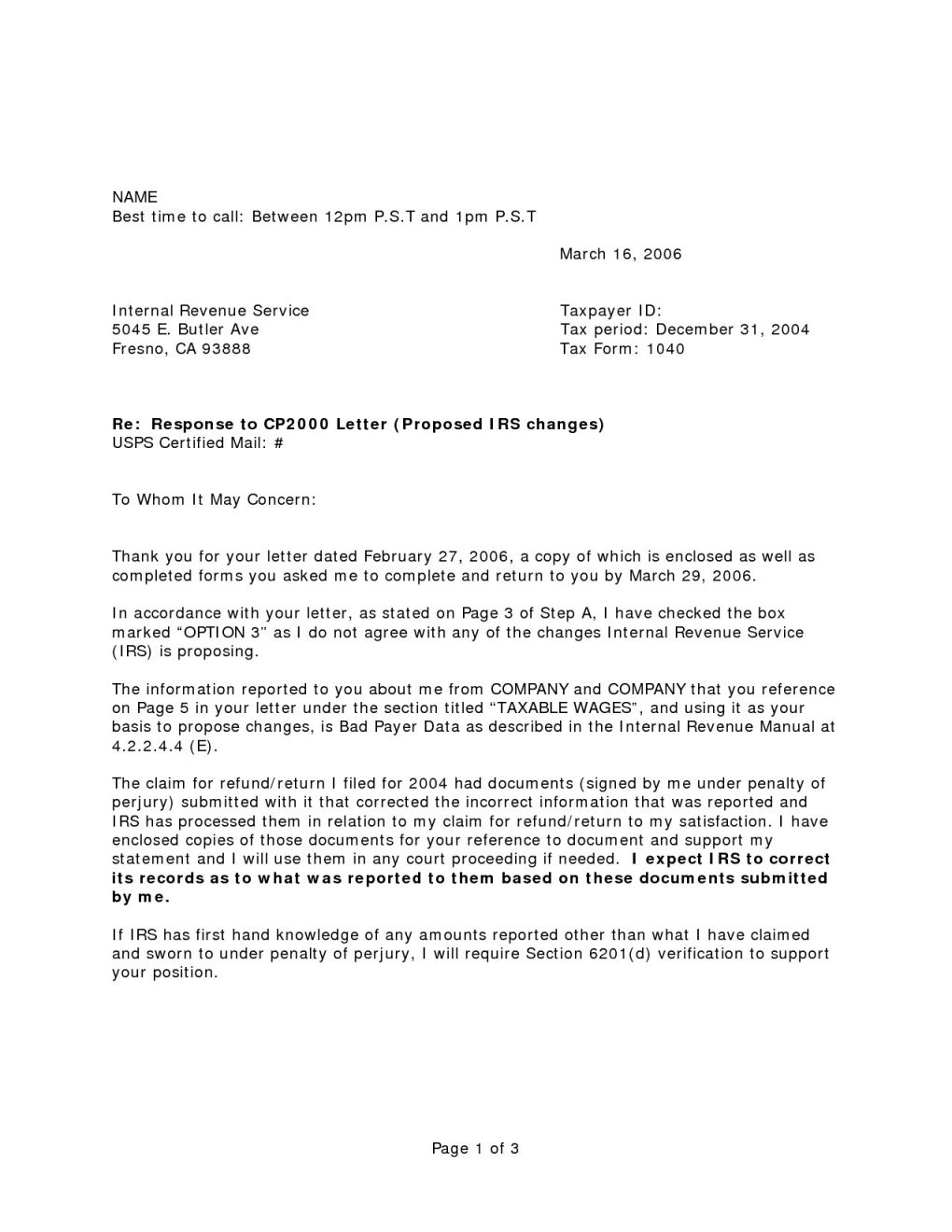

Clearly state the relevant facts and. There is no magic formula for writing a letter to the irs. To use the irs' tracker tools, you'll need to provide your social security number or individual taxpayer identification number, your filing status (single, married or head of.

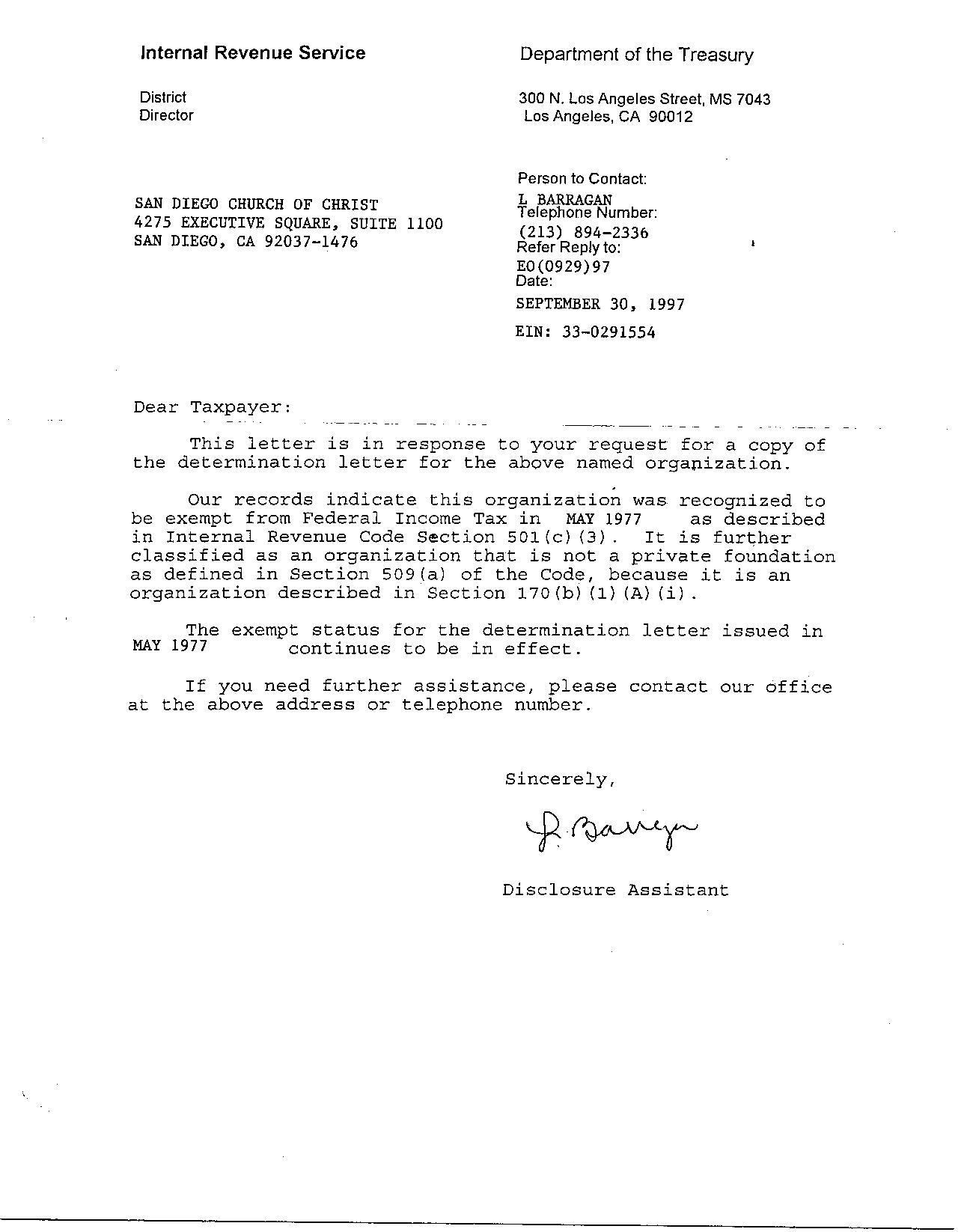

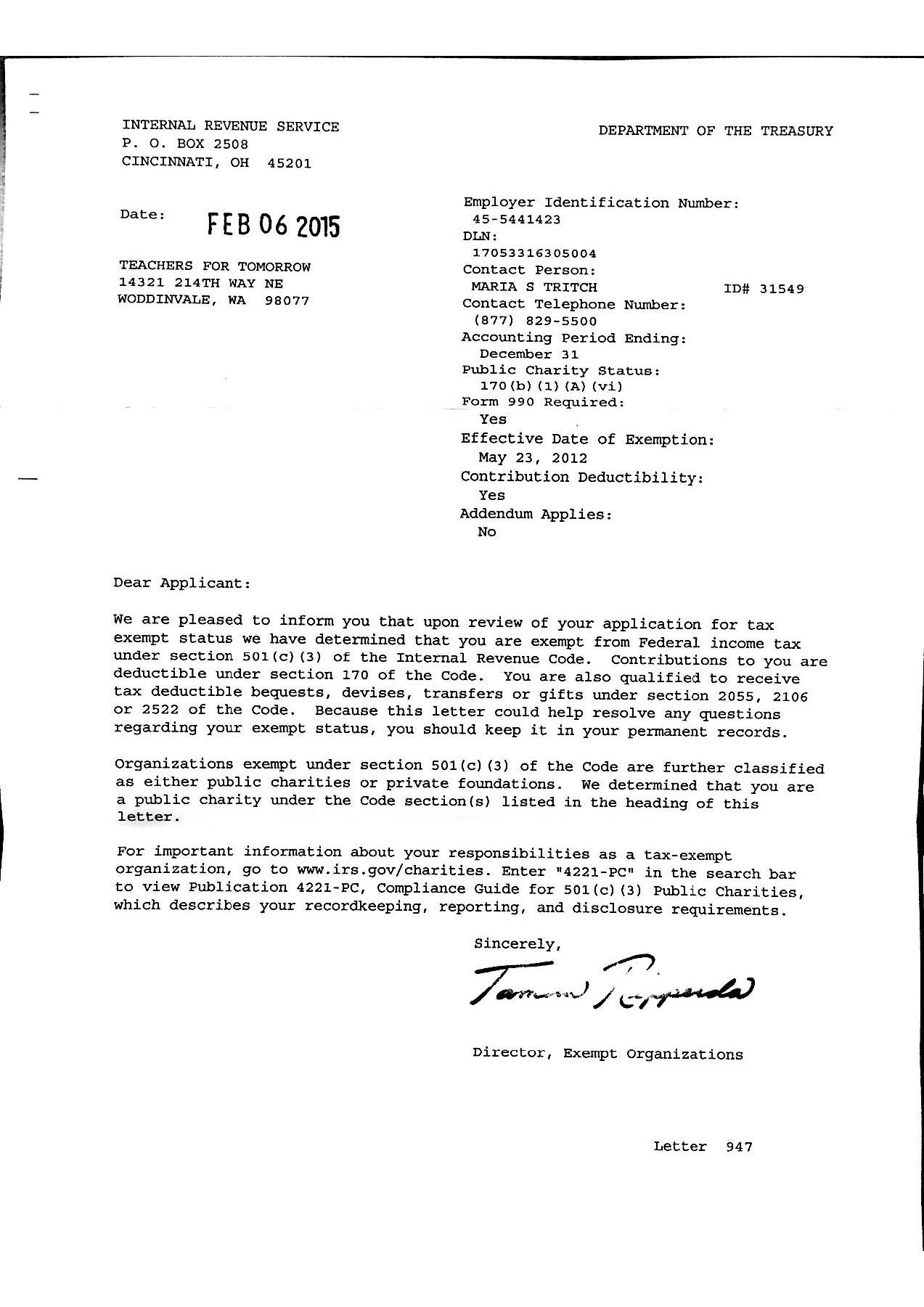

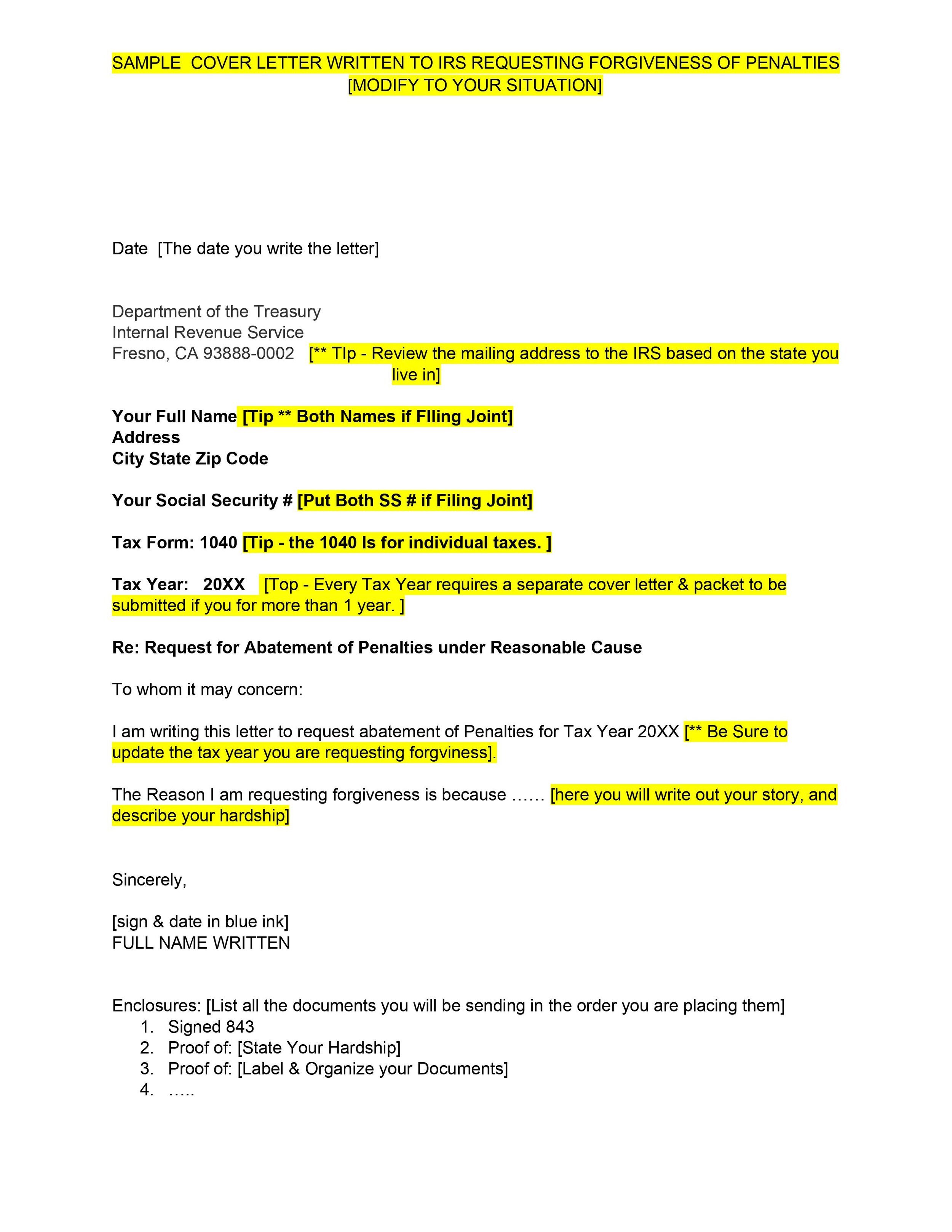

According to the irs, your letter should include the following: While writing a letter to the irs may seem like a daunting task, it is important to remember that clear and concise communication is key. Begin with a polite and respectful tone.

The irs sends out letters or notices for many reasons. Who needs to letter an explanation letter to the irs? A specific issue on your federal tax return or account;

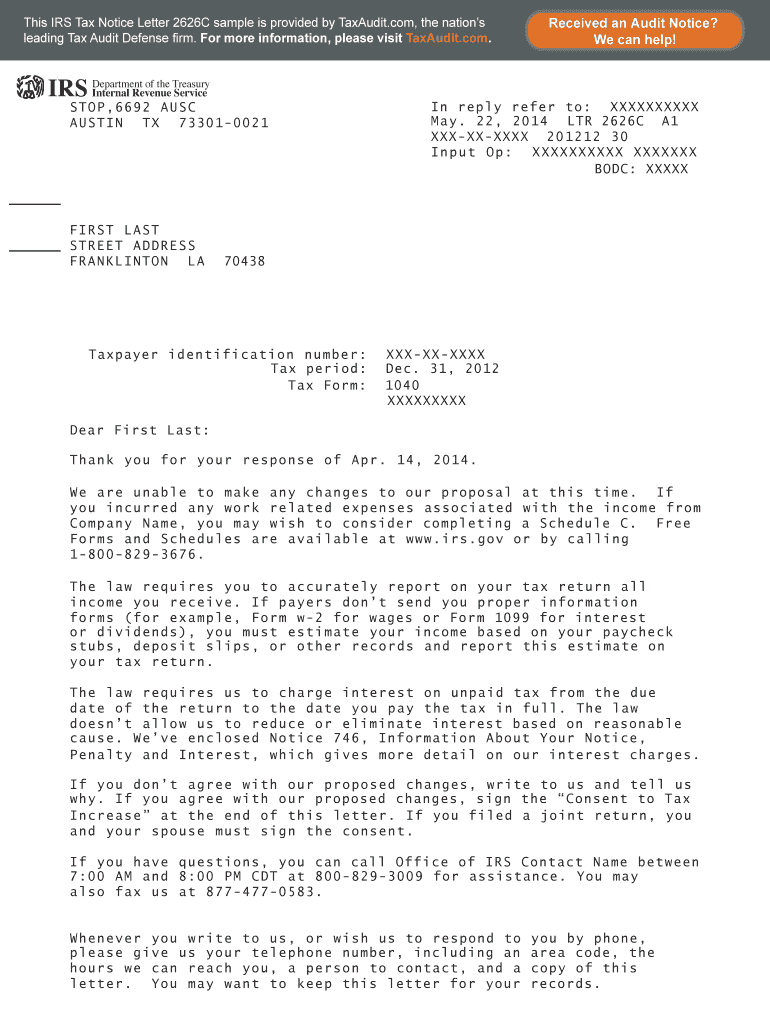

A letter or notice from the irs doesn’t necessarily mean you're being audited. Generally, it’s about a specific issue with a taxpayer’s federal tax return or tax account. Before you start composing your letter, familiarize yourself with the specific guidelines and procedures outlined by the irs.

You can reach representatives between 7 a.m. Did you receive an irs notice or letter? The irs will send a notice or a letter for any number of reasons, including:

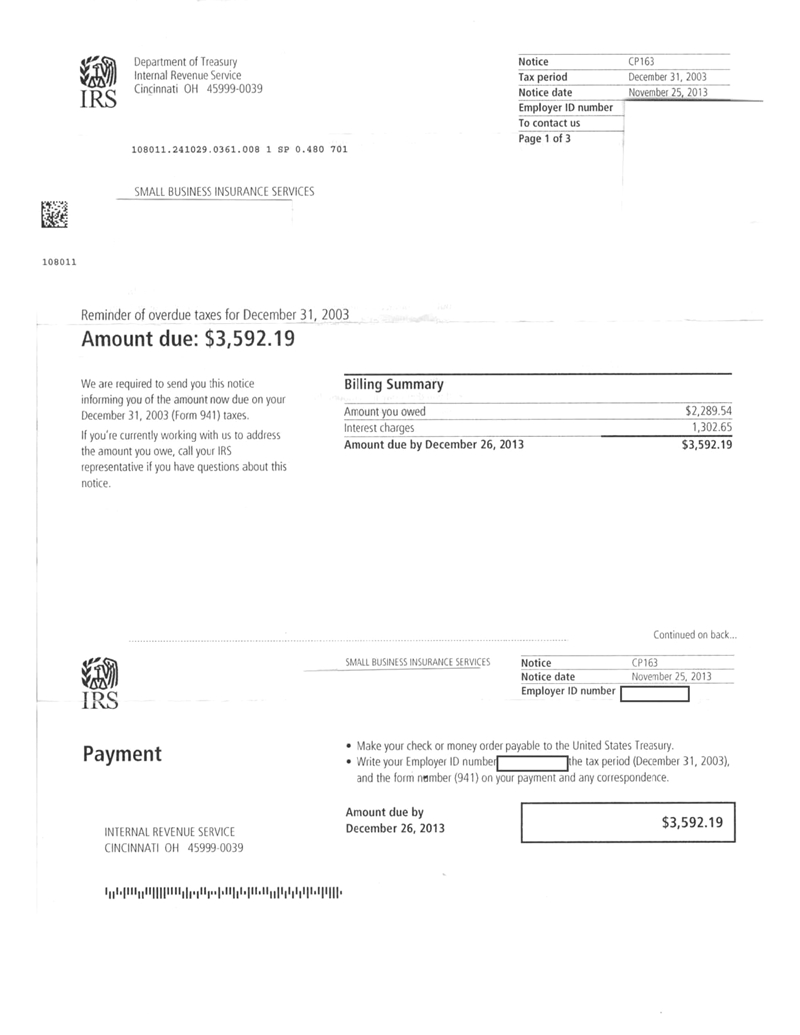

They have a balance due. Explaining changes to your return or. Residents of alaska and hawaii should follow pacific time.

If you have tax debt, resolve it to avoid. A statement expressing your desire to appeal. If the notice lists missing tax returns from past years, complete them as soon as possible.

Understanding letters from the irs: How to write an explanation zeichen to the irs. Search for your notice or letter to learn what it means and what you should do.